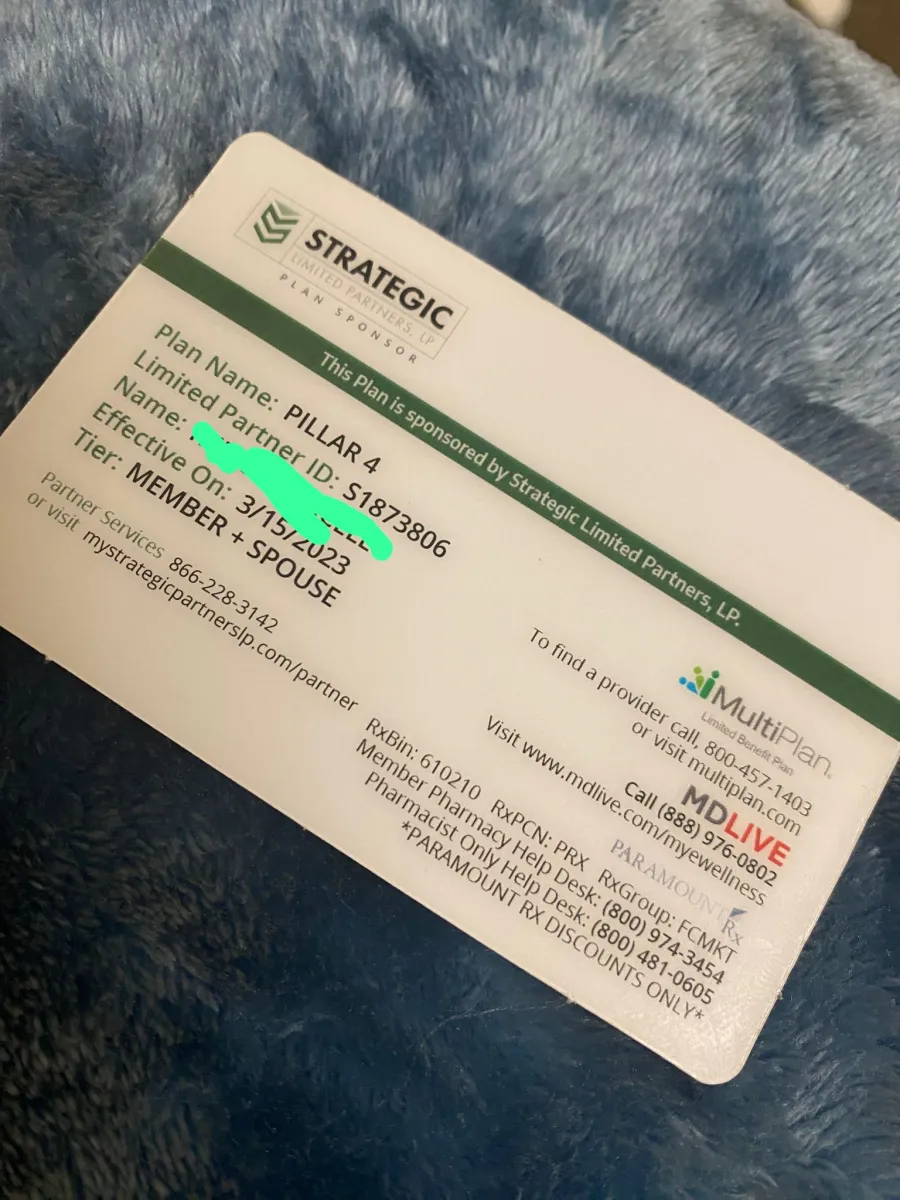

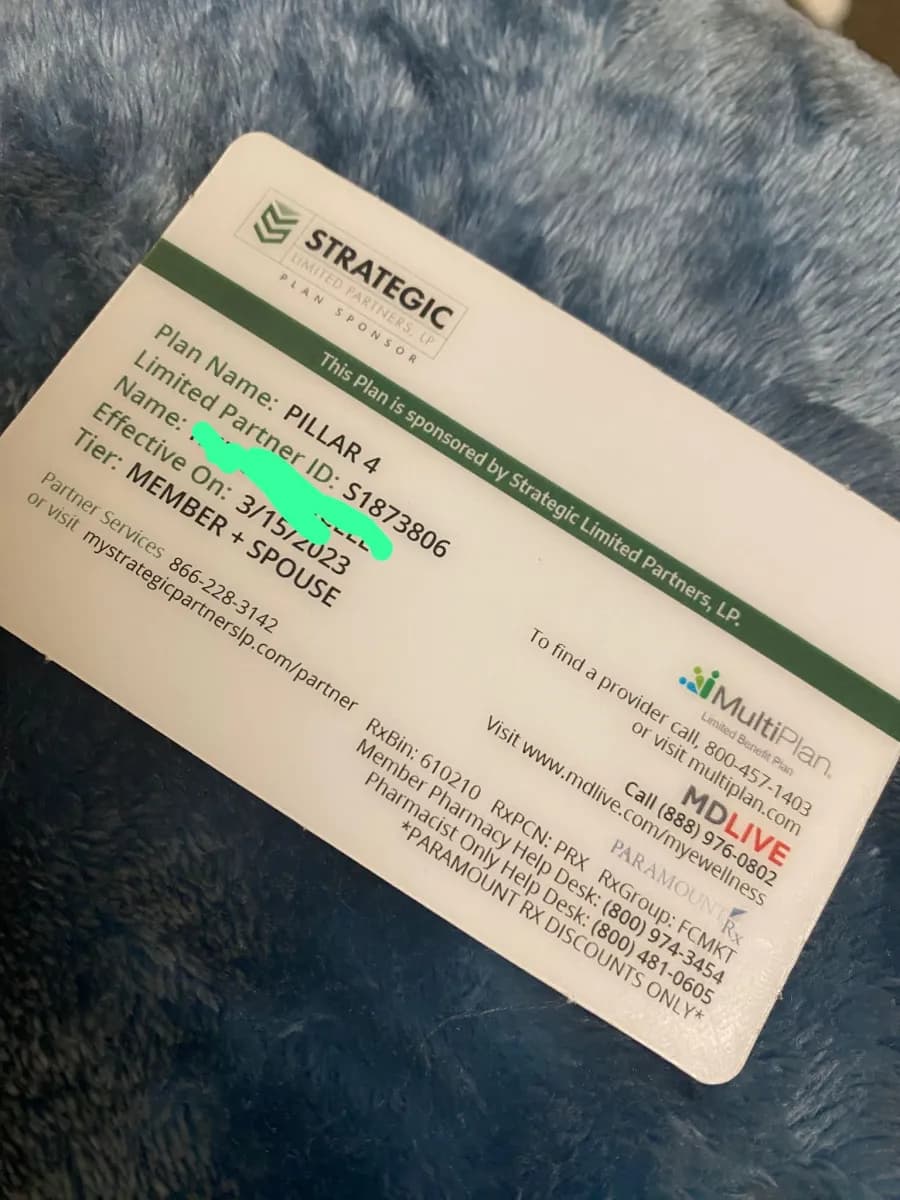

Strategic Limited Partners Insurance offers comprehensive insurance solutions for businesses. Their services include risk management and coverage for various industries, ensuring financial protection and peace of mind for their clients.

Strategic Limited Partners Insurance is a trusted provider of insurance solutions for businesses, offering comprehensive coverage and risk management services across various industries. With their expertise and tailored approach, they ensure that clients are well-protected and prepared for any potential risks.

Whether it’s property, liability, or specialty coverage, Strategic Limited Partners Insurance provides the necessary support and peace of mind for businesses to thrive. Their commitment to excellence and personalized service sets them apart as a valuable partner for businesses seeking reliable insurance solutions.

Credit: www.strategic-partnersinc.com

Why Insurance Is Important

Insurance plays a crucial role in protecting individuals, businesses, and organizations from unexpected events that may result in significant financial losses. Strategic Limited Partners Insurance is an insurance policy designed to protect investors in private equity funds from potential risks and losses that may occur during the investment period. In this section, we will discuss the importance of insurance, specifically Strategic Limited Partners Insurance, and the benefits it offers to investors.

Protection Against Unforeseen Events

One of the primary reasons why insurance is important is that it provides protection against unforeseen events that may impact an individual or business’s financial stability. In the case of Strategic Limited Partners Insurance, investors are protected against potential losses that may occur during the investment period due to various unforeseen events such as natural disasters, economic downturns, or company-specific issues. With Strategic Limited Partners Insurance, investors can have peace of mind knowing that their investments are protected against unforeseen events that may cause significant financial losses. This protection enables investors to focus on their investments without worrying about potential risks that may arise during the investment period.

Minimizing Financial Risks

Investing in private equity funds can be risky, and investors may face significant financial losses if their investments do not perform as expected. Strategic Limited Partners Insurance helps to minimize these risks by providing protection against potential losses that may occur during the investment period. By having Strategic Limited Partners Insurance, investors can reduce their exposure to financial risks and protect their investment portfolio from potential losses. This protection enables investors to make informed investment decisions without worrying about potential financial risks that may arise during the investment period.

Conclusion

Strategic Limited Partners Insurance is an essential tool that provides protection to investors in private equity funds. The insurance policy protects investors from potential financial losses that may arise due to unforeseen events or company-specific issues. With Strategic Limited Partners Insurance, investors can minimize their financial risks and focus on making informed investment decisions.

Introduction To Strategic Limited Partners Insurance

Strategic Limited Partners Insurance provides comprehensive coverage for limited partners, protecting their investments and mitigating potential risks. This specialized insurance offers peace of mind and ensures the smooth operation of strategic partnerships.

Definition Of Strategic Limited Partners

Strategic Limited Partners are investors who invest in private equity funds, venture capital funds, and other alternative investment vehicles. These investors typically provide capital to the fund manager to invest in a diversified portfolio of companies. In return for their investment, the Strategic Limited Partners receive a share of the profits generated by the fund.

Explanation Of The Insurance Concept

Strategic Limited Partners Insurance is a type of insurance that protects the limited partners in a private equity fund or venture capital fund from potential liabilities. This insurance is designed to provide coverage for any losses that may arise due to the actions of the fund manager or any other party involved in the fund. The insurance concept works by providing coverage for various risks, including litigation, regulatory investigations, and other legal liabilities. The coverage can extend to the limited partners themselves, as well as the fund manager and other parties involved in the fund. The insurance policy is typically purchased by the fund manager on behalf of the limited partners, with the cost of the policy being paid for out of the fund’s assets. The policy is designed to provide peace of mind to the limited partners, knowing that they are protected from potential risks and liabilities. In conclusion, Strategic Limited Partners Insurance is an important concept to understand for investors who are considering investing in private equity funds or venture capital funds. By providing coverage for potential liabilities, this insurance can help to minimize the risks associated with investing in these types of funds.

Understanding The Benefits Of Strategic Limited Partners Insurance

Strategic Limited Partners Insurance offers protection for limited partners against potential risks and liabilities within their investment portfolios. Understanding the benefits of this insurance ensures peace of mind and safeguards the interests of limited partners, providing financial security and mitigating potential losses.

As an investor, it is important to protect your investment capital and mitigate risks in the investment process. Strategic Limited Partners Insurance (SLPI) is an insurance policy that provides coverage for legal liabilities and protects your investment capital. In this blog post, we will discuss the benefits of SLPI in detail.

Protection Of Investment Capital

SLPI provides protection for your investment capital in case of unexpected events. For instance, if a portfolio company faces financial distress or insolvency, SLPI will provide coverage for the loss of your investment. This means that you can recover your investment capital and minimize losses.

Coverage For Legal Liabilities

Investing in private equity and venture capital comes with legal risks. SLPI provides coverage for legal liabilities related to your investments. For instance, if a portfolio company faces a lawsuit, SLPI will provide coverage for the legal fees and damages. This means that you can avoid the financial burden of legal liabilities and protect your investment returns.

Mitigating Risks In The Investment Process

Investing in private equity and venture capital involves risks such as market volatility, operational risks, and fraud. SLPI helps mitigate these risks by providing coverage for unexpected events. This means that you can invest with confidence, knowing that your investments are protected. In conclusion, Strategic Limited Partners Insurance is an important tool for investors to protect their investment capital, mitigate risks, and avoid legal liabilities. By investing in SLPI, you can ensure that your investments are protected and your returns are maximized.

Choosing The Right Insurance Provider

When selecting an insurance provider, it’s crucial to consider the strategic advantages of partnering with a company like Strategic Limited Partners Insurance. Their tailored solutions and expertise in risk management can provide the right coverage for your specific needs, ensuring peace of mind and protection for your assets.

When it comes to strategic limited partners insurance, choosing the right insurance provider is crucial for protecting your investments. With so many insurance companies out there, it can be overwhelming to decide which one is the right fit for you. Here are some key factors to consider when choosing an insurance provider:

Researching Insurance Companies

Before choosing an insurance provider, it’s important to do your research. Look for companies that specialize in strategic limited partners insurance and have a strong reputation in the industry. Check their financial stability and ratings from independent rating agencies like A.M. Best or Moody’s. Look for customer reviews and testimonials to get a sense of their customer service and claims handling.

Evaluating Coverage Options

Once you’ve narrowed down your options, it’s time to evaluate their coverage options. Look for a policy that covers a wide range of risks, including liability, property damage, and loss of income. Make sure the policy includes coverage for cyber liability, as cyber threats are becoming increasingly common in the investment industry. Consider the deductible and limits of liability to ensure they align with your needs.

Comparing Pricing And Terms

Finally, it’s important to compare pricing and terms between insurance providers. Look for a policy that offers competitive pricing without sacrificing coverage. Make sure you understand the policy’s terms and conditions, including any exclusions or limitations. Compare the policy’s terms with other insurance providers to make an informed decision. In conclusion, choosing the right insurance provider for your strategic limited partners insurance is a critical decision. By researching insurance companies, evaluating coverage options, and comparing pricing and terms, you can ensure that you’re getting the best coverage for your needs.

Key Considerations For Policyholders

When it comes to protecting your business investments, Strategic Limited Partners Insurance offers comprehensive coverage tailored to your unique needs. As a policyholder, it is essential to be aware of the key considerations that can impact your coverage and ensure you make informed decisions. In this article, we will explore three important factors to keep in mind: policy exclusions and limitations, claims process and customer support, and renewal and cancellation policies.

Policy Exclusions And Limitations

Before purchasing an insurance policy, understanding the exclusions and limitations is crucial. These provisions outline the circumstances under which the insurer may deny coverage or limit the benefits paid out. It is important to carefully review this section to ensure you have a clear understanding of what is covered and what is not. Some common exclusions and limitations you may come across include:

| Exclusions | Limitations |

|---|---|

|

|

By understanding these exclusions and limitations, you can make sure your policy aligns with your specific needs and expectations.

Claims Process And Customer Support

When the unexpected happens, having a smooth and efficient claims process is crucial. Before choosing an insurance provider, it is essential to inquire about their claims process and customer support. Some key aspects to consider include:

- 24/7 claims reporting

- Multiple channels for reporting claims (phone, email, online)

- Timely processing and settlement of claims

- Knowledgeable and responsive customer support team

By selecting an insurance provider with a streamlined claims process and exceptional customer support, you can have peace of mind knowing that any potential claims will be handled promptly and efficiently.

Renewal And Cancellation Policies

Understanding the renewal and cancellation policies of your insurance policy is essential to avoid any surprises down the line. Be sure to review the terms and conditions related to policy renewals and cancellations. Some key considerations include:

- Notification period for policy renewals and cancellations

- Ability to renew or cancel the policy at any time

- Any penalties or fees associated with early cancellation

By familiarizing yourself with these policies, you can make informed decisions about your coverage and ensure it continues to meet your evolving needs.

Common Types Of Insurance Coverage For Limited Partners

When it comes to protecting the interests of limited partners, having the right insurance coverage is crucial. Common types of insurance coverage for limited partners include professional liability insurance, directors and officers insurance, cybersecurity insurance, and property and casualty insurance. Let’s delve into each of these types in more detail.

Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, provides coverage for claims related to professional services. This type of insurance protects limited partners from liabilities arising from errors, omissions, negligence, or malpractice in their professional services.

Directors And Officers Insurance

Directors and officers insurance, often referred to as D&O insurance, offers protection for limited partners serving on the board of a company. It provides coverage for legal expenses and damages in the event of lawsuits alleging wrongful acts, errors in judgment, or mismanagement by the directors and officers.

Cybersecurity Insurance

Cybersecurity insurance, also known as cyber liability insurance, safeguards limited partners against the financial impact of cyber-attacks and data breaches. This type of insurance covers expenses related to data recovery, notification costs, legal fees, and regulatory fines resulting from a cyber incident.

Property And Casualty Insurance

Property and casualty insurance provides coverage for physical assets and liabilities. It protects limited partners from financial losses due to property damage, theft, or liability claims. This type of insurance is essential for safeguarding the tangible assets and operations of limited partners.

Case Studies: Real-Life Examples of Insurance Success Stories

Case Study 1: Protecting Investment Funds From Fraud

Strategic Limited Partners Insurance offers a compelling case study of protecting investment funds from fraud. In one real-life scenario, a limited partner’s investment fund faced potential losses due to fraudulent activities within the fund. However, with the right insurance coverage in place, the affected limited partners were able to recover their losses, safeguarding their investments from substantial financial harm.

Case Study 2: Legal Defense Coverage For Limited Partners

Another remarkable example of insurance success involves legal defense coverage for limited partners. In this case, a limited partner encountered a legal dispute related to their investment activities. With the support of Strategic Limited Partners Insurance, the partner received comprehensive legal defense coverage, ensuring protection against costly litigation expenses and safeguarding their financial interests.

Case Study 3: Reimbursement For Cybersecurity Breaches

Strategic Limited Partners Insurance excels in providing reimbursement for cybersecurity breaches. In a real-life incident, a limited partner’s firm encountered a cybersecurity breach, potentially compromising sensitive data. Through the insurance policy, the partner received swift reimbursement for the incurred expenses, effectively mitigating the financial impact of the breach and reinforcing the firm’s cybersecurity measures.

Credit: scammer.info

Conclusion And Final Thoughts

Strategic Limited Partners Insurance offers comprehensive coverage tailored to the specific needs of limited partners. With a wide range of insurance options and strategic planning, they provide peace of mind for investors in various industries. Their expertise and personalized approach make them a reliable choice in the insurance market.

Importance Of Strategic Limited Partners Insurance

Strategic Limited Partners Insurance is an essential safeguard for investors, providing them with peace of mind and protection against potential risks. By taking proactive steps to protect their investments, investors can ensure that their financial future is secure. When it comes to investing in various projects or ventures, there are always inherent risks involved. These risks can include market volatility, unexpected events, or even the mismanagement of funds. Without the proper protection, investors may find themselves facing significant losses.

Strategic Limited Partners Insurance acts as a safety net, mitigating these risks and providing financial security. This type of insurance covers a wide range of potential risks, such as the default of a borrower, the failure of a project, or even legal liabilities. By obtaining Strategic Limited Partners Insurance, investors can rest assured that their investments are well-protected. This insurance provides compensation in case of any unforeseen circumstances, ensuring that investors can recover their losses and continue to grow their portfolios.

Taking Proactive Steps To Protect Investments

Investors who take the proactive step of obtaining Strategic Limited Partners Insurance demonstrate their commitment to safeguarding their investments. By doing so, they are taking a responsible approach to risk management and ensuring that their financial future is secure. One of the primary benefits of Strategic Limited Partners Insurance is its ability to provide coverage for a wide range of risks. This comprehensive coverage ensures that investors are protected from potential pitfalls that could otherwise result in significant financial losses. Moreover, this insurance allows investors to focus on their investment strategies without constantly worrying about the potential risks involved.

It provides a sense of security, enabling investors to make more informed decisions and pursue opportunities that they might otherwise have been hesitant to explore. Investing in projects or ventures always comes with a degree of uncertainty, but Strategic Limited Partners Insurance helps to mitigate this uncertainty. It serves as a safety net, reducing the overall risk associated with investments and providing investors with the confidence to pursue opportunities that align with their financial goals. In conclusion, Strategic Limited Partners Insurance is an important tool for investors to protect their investments and secure their financial future. By taking proactive steps to obtain this insurance, investors can mitigate risks, recover potential losses, and focus on growing their portfolios with confidence.

Credit: medium.com

Frequently Asked Questions

What Are The Strategic Benefits Of Partnering?

Collaborating with the right partner can also help in achieving common goals, fostering innovation, and improving business operations.

What Is A Strategic Partner?

A strategic partner is a business or individual that collaborates to achieve mutual goals. They provide expertise, resources, and support to help each other succeed. This partnership is built on trust, communication, and shared vision for long-term success.

What Is The Difference Between A Partnership And A Strategic Partnership?

Strategic partnerships are more structured and involve long-term planning and alignment of resources.

What Is A Strategic Partnership Agreement?

A strategic partnership agreement is a formal agreement between two or more companies to work together to achieve common goals.

Conclusion

Strategic limited partners insurance is a crucial investment for any business seeking to mitigate risks associated with limited partnerships. It offers protection to both the general and limited partners by covering unforeseen liabilities and providing financial security. With the right insurance plan, businesses can focus on their operations without worrying about potential legal and financial setbacks.

Don’t hesitate to consult with an insurance professional to get started on securing your business’s future.